The NYC Homeownership Network

NYC residents are locked out of the homeownership market due to a variety of systemic barriers. We aim to change this through the network.

THIS PROGRAM IS BROUGHT TO YOU BY

We are also proud to present that we have improved our website to be ADA Compliant.

About

The New York City Homeownership Network (NYCHN), led by Local Initiatives Support Corporation NY, Neighborhood Housing Services of NYC, and The Center for New York City Neighborhoods, tackles barriers to creating and preserving homeownership for NYC residents. Funded by Wells Fargo’s WORTH Initiative, NYCHN’s partners focus on key areas: The Center manages the TOPA/COPA database, LISC NY oversees the NYC Homeownership Network, and NHS NYC handles the Open Access Fund.

We aim to support 5,000 NYC residents of New York City to create and preserve housing by the end of 2025.

Our Services

With decades of experience supporting New York residents with housing counseling, legal services, down payment assistance, and financial coaching, NYC Homeownership Network will work with you to build stability and security for your family. We offer the following services:

Homeownership Education

- Program Description

- Eligibility Requirements

- First-time Homebuyer Education

Technical

Assistance

- Financial Education Seminars

- Legal Counseling

- One-on-One Coaching

- Credit Counseling

- Referral to brokers and appraisers

Lending

- Prequalification

- Mortgage Assistance & Information

- Down Payment Assistance

- Closing Cost

Preservation

- Home Repairs

- Foreclosure Prevention

- Loan Modification

- Property Tax Assistance

- Title and Deed Transfer

Our Plan for You

Owning a home is one of life’s biggest milestones — a foundation for lasting stability and security for you and your family. With our support every step of the way, your goal of becoming a homeowner is within reach.

1. Assessment

Our lending team will evaluate your readiness and ability to qualify for a mortgage loan.

2. Action

A curated educational and counseling plan will be developed to increase the level playing of buying a home.

3. Check-ins

We’ll help you from the beginning of your application until you become a successful homeowner.

Mortgage Calculator

On this screen, please input all information fields, for a preview of what you most likely could afford as a mortgage. This is an estimate, and actual monthly affordability could be different based on lender.

Mortgage Terminologies And Recommendations

As a guidance, it is always good to consider your buying power being about 28% of your monthly gross income, OR, 36-43% or your gross monthly income that INCLUDES all other liabilities you have on a monthly basis. Choosing the right mortgage type depends on your financial situation, long-term goals, and personal preferences. Consider factors such as how long you plan to stay in the home, your ability to handle fluctuating payments (for ARMs), and your eligibility for government-backed loans. Consulting with a mortgage advisor can help you make an informed decision based on your individual circumstances. For purposes of this mortgage calculations, the 2 most common types of loan calculations will be used – Fixed or Variable

As with any offering, there are multiple types of mortgages available in the market, all individuals will not qualify for all types.

Terminologies

Mortgages

- Fixed-Rate Mortgages: Stability and predictability in payments.

- ARMs: Lower initial rates but variable payments after the fixed period.

- Interest-Only Mortgages: Lower initial payments with future payment increases.

- Balloon Mortgages: Low initial payments but a large final payment.

Loans

- FHA Loans: Low down payment, flexible credit requirements, and mortgage insurance.

- VA Loans: No down payment or PMI for eligible borrowers. Have to be ex-military to qualify.

- USDA Loans: No down payment for eligible rural areas. Has to be in a RURAL area.

- Jumbo Loans: For high-value properties, often with stricter terms.

Recommendations

Suggestions on paying off mortgages early are below. Again, each opportunity should be weighted for your unique financial situation;

– Extra Payments: Make additional principal payments, biweekly payments, or round up your payments.

– Refinance: Consider refinancing to a shorter term or a lower interest rate.

– Apply Windfalls: Use tax refunds, bonuses, or extra income towards the mortgage.

– Increase Payments: Adjust your budget to increase monthly payments.

– Lump-Sum Payments: Make occasional large payments when possible.

– Mortgage Accelerators: Check for lender programs that help accelerate payments.

– Cut Expenses: Reduce unnecessary spending and redirect savings.

– Maintain Home: Keep your home well-maintained to avoid unexpected costs.

– Avoid New Debt: Minimize additional debt to stay financially flexible.

Mortgage Calculator

Questions about mortgage terms? Check out our quick guide

Please enter all the required information into the fields and then click the 'Calculate' button to view our recommendations and suggestions.

Mortgage Finder of New York City

Welcome to the Mortgage Finder of New York City page. Please choose the borough of your choice below for a listing of all mortgage brokers operating and authorized for mortgaging in that borough.

| Mortgage Lender | Address | ZIP Code | Borough | Phone | |

|---|---|---|---|---|---|

| Marc Seligman | 505 White Plains | 10591 | Westchester | marc.seligman@bofa.com | 9146136608 |

| Patricia Strong | 898 E Veterans Memorial Highway | 11788 | Suffolk | patricia.strong@dime.com | 7187826200 x 5245 |

| Maria Guillen | Rego Park, NY | 11374 | Queens | maria.guillen@citi.com | 9177558718 |

| Youcef Dahli | 15116 84th St, Howard Beach | 11414 | Queens | - | 3478361126 |

| Max Perez | 219-01 Jamaica Avenue, Queens Village | 11428 | Queens | max.perez@chase.com | 6463635457 |

| Carlos Morales | 94-05 63rd Drive, Regal Park, NY | 11374 | Queens | cjmorales@valley.com | 917 968 8815 |

| Felix de la Cruz | 69-20 80th Street, Middle Village | 11379 | Queens | fdelacruz@valley.com | 6462969789 |

| Elliot Epperson | - | - | Queens | elliott.epperson@td.com | 3473661317 |

| Rafael Bellber | 437 Madison Avenue 18th Floor | 10173 | Mew York | Rafael.Bellber@Citizensbank.com | 9172704610 |

| Felix de la Cruz | 350 Park Avenue | 10022 | Manhattan | fdelacruz@valley.com | 6462969789 |

| Ginny Chin | 275 7th Ave., NY, NY | 10001 | Manhattan | ginnychin@amalgamatedbank.com | 9172247521 |

| Adrian Intriago | 1 Broadway, NY, NY | 10004 | Manhattan | Adrian.triago@citi.com | 347 330 7021 |

| Laura Kelly | 1 Huntington Quadrangle, Suite 1N16, Melville, NY | 11747 | Bronx | laura.kelly@dime.com | 6318568321 |

| Kira Guzman | 900 Stewart Ave., Garden City | 31152 | - | kira.guzman@flagstar.com | 3474231622 |

| Alfred Pico | - | - | - | Alfred.pico@wellsfargo.com | 9178361123 |

| Aubrey Nurse | - | - | - | anurse@mtb.com | 6319428302 |

| Byron Logan | - | - | - | Blogan@mtb.com | 9146984022 |

| Darrin English | - | - | - | Denglish@quonticbank.com | 7182154085 |

| Duane Wright | - | - | - | dwright@mtb.com | 6464529837 |

| Erika Sanchez | - | - | - | erika.sanchez3@bofa.com | 3475473851 |

| Evette Monteith | - | - | - | emonteith@popular.com | 9178689915 |

| Greg Diaz | - | - | - | gdiaz1@mtb.com | 646 296 9190 |

| Jason Gajraj | - | - | - | jason.gajraj@chase.com | 718 9163181 |

| Jean Volcy | - | - | - | Jvolcy@unmb.com | 9142689336 |

| Jennifer Smith | - | - | - | Jennifer.L.Smith@citizensbank.com | - |

| Jewel Williams | - | - | - | jewel.r.williams@citzensbank.com | 8482487788 |

| Juan Cueto | - | - | - | juan.cueto@eastwestbank.com | 6467510531 |

| Maria Serravalle | - | - | - | Maria.Serravalle@bofa.com | - |

| Marian Ruiz | - | - | - | miriam.ruiz@flagstar.com | 9174063939 |

| Michael O´Leary | - | - | - | moleary@ridgewoodbank.com | 3475631046 |

| Michelle Bage | - | - | - | michelle.bage@citi.com | - |

| Miriam Ruiz | - | - | - | Miriam.Ruiz@flagstar.com | 9174063939 |

| Patrick Cronin | - | - | - | Pcronin1@mtb.com | - |

| Ricardo Perez | - | - | - | r.perez@citi.com | 347 337 1059 |

| Samuel Ward | - | - | - | samuel.d.ward@wellsfargo.com | 3473106862 |

| Shaun Sproul | - | - | - | shaun@cliffcomortgage.com | 5164087300 |

| Shawn Kelly | - | - | - | shawn.kelly@eastwestbank.com | 9295033704 |

| Tenise Sang | - | - | - | tenise.sang@chase.com | 347 806 5938 |

| Travis Bowens | - | - | - | tbowens@cmghomeloans.com | 8456561718 |

| Valerie Tyler | - | - | - | Valerie.tyler@citi.com | 3472660735 |

| Victoria Purcell CD | - | - | - | Victoria_a_purcell@keybank.com | 8454833010 |

| Yvon Ponce DeLeon | - | - | - | yponcedeleon@ridgewoodbank.com | 3478342265 |

| Duane D. Wright | 277 Park Avenue | 10172 | dwright@mtb.com | 6464529837 |

Our Process

Becoming a homeowner can be an overwhelming process. And, no two journeys are alike. Our experienced network members will meet you where you are at.

Track 1: Obtaining Information — no timeline to buy:

NYCHN Support Offered: Educational Resources

✔ General homebuyer resources including fact sheets and tool kits on relevant topics

✔ Training opportunities for practitioners (policy briefings, best practices) and prospective homeowners

Track 2: Actively seeking pre-qualification/ pre-approval prior to home search — 6-12 months out from purchase

NYCHN Support Offered:

✔ One-stop shop for first-time home-buyer counseling scheduling amongst network participants

✔ Database of mortgage options for buyers to ‘shop’ from

✔ Direct connection to down-payment assistance through linkages to housing counselors

Track 3: Pre-approval obtained and viewing properties with intent to purchase in 0-3 months.

NYCHN Support Offered: Professional support directories

✔ Directory of affordable focused marketing agents affordable focused legal counsel home inspectors and homeowner insurance providers

Track 4: Current homeowner focused on stabilization of asset

NYCHN Support Offered: Post Purchase Stabilization Resources

✔ General resources including fact sheets and tool kits

✔ Training opportunities for practitioners (policy briefings, best practices) and existing homeowners

✔ Directories of repair financing options, financial coaching and loan modification services

Why the NYC Home-Ownership Network?

Owning a home is one of the most important steps you can take on the road to financial stability and building wealth, but it’s becoming increasingly out of reach for too many NYC residents.

Owning a home is one of the most important steps you can take on the road to financial stability and building wealth, but it’s becoming increasingly out of reach for too many NYC residents.

We believe the pursuit of homeownership should be available to all, regardless of background, current income or financial standing. Each homeownership journey begins with education, support, and access to resources.

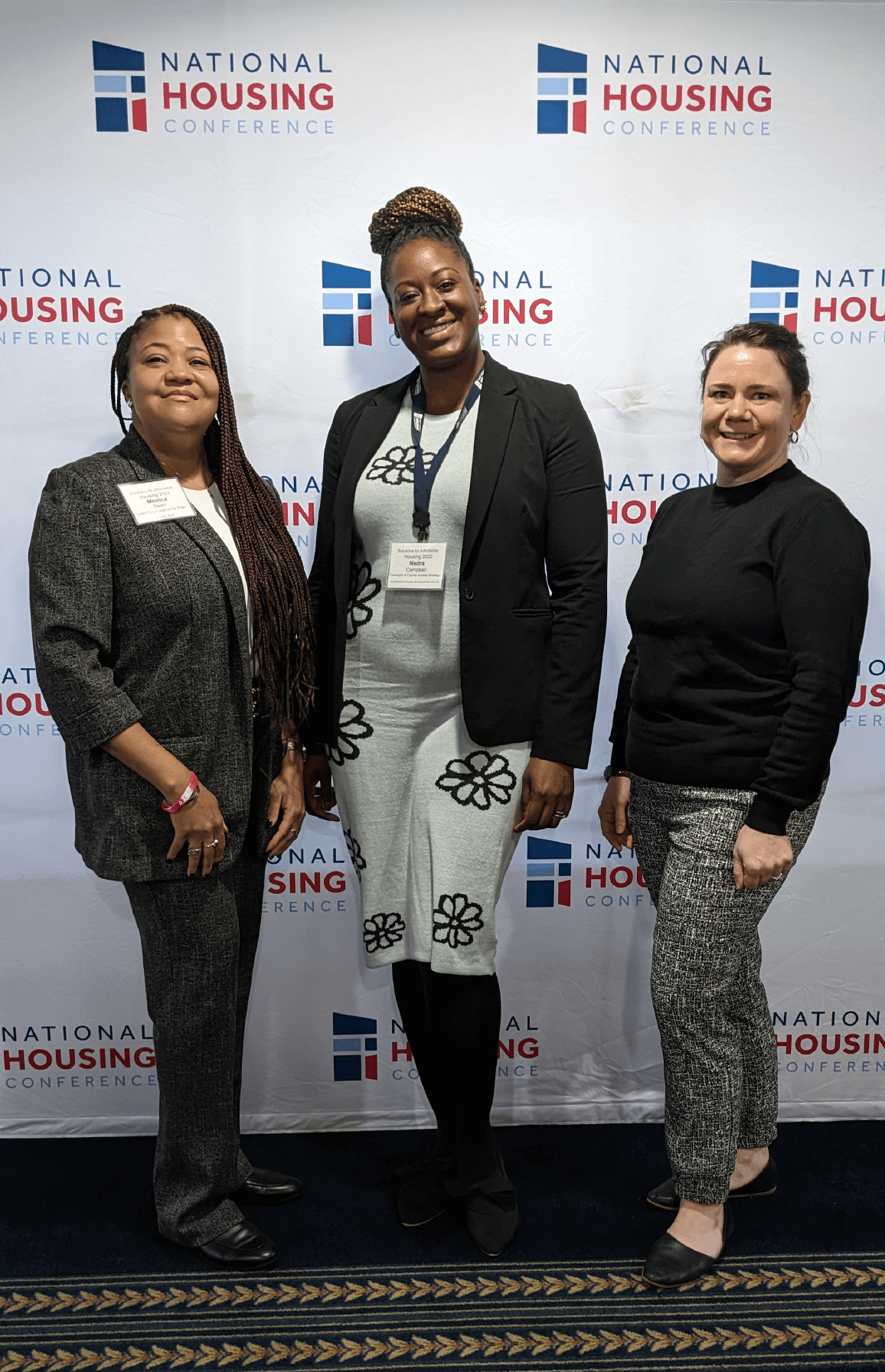

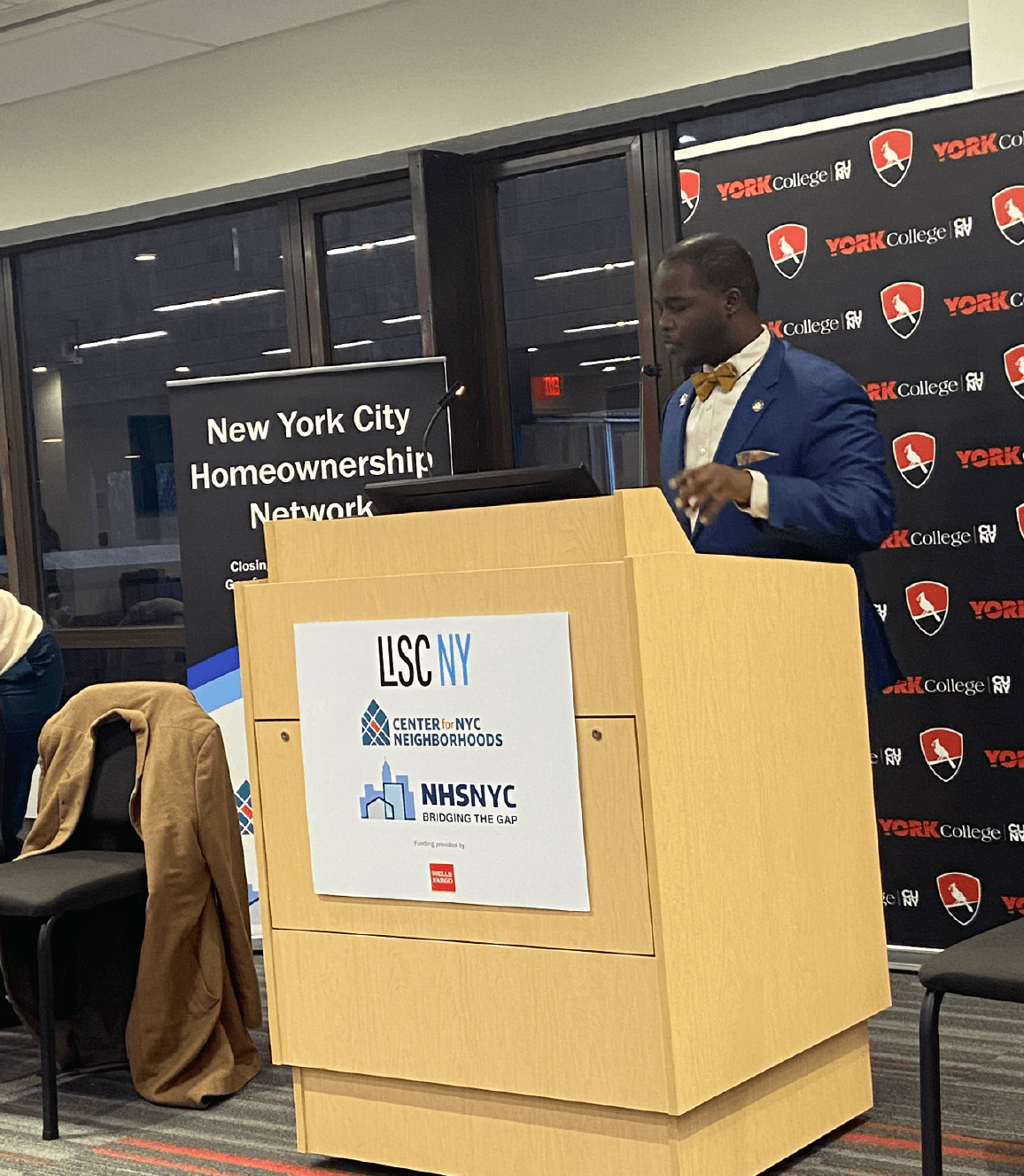

EVENTS GALLERY

PARTNER FIRST TIME

HOMEBUYER SCHEDULE

Harlem Congregations fo Community Improvement Inc

Virtual

Free

English - Spanish

HCCI offers a free virtual 4 - part seminar series on Thursday evenings from 7:00 - 9:30 p.m. The series starts the first Thursday of the month and goes through the fourth Thursday of the month. The Spanish sessions are offered on Tuesdays and Thursdays from 7:00 - 9:00 p.m. on the third and fourth weeks of the month.

Chhaya CDC

Virtual

Free

English

Chhaya offers a free, virtual two-part First Time Homebuyer class. Registration is not required. Both sessions need to be completed for the certificate to be rewarded. Topics covered include How to decide if owning a home is right for you; Myths and truths about homeownership; Understanding equity; Resources for downpayment assistance.

NHS NYC

Virtual

Free

English - Spanish

A 5-hour course taught on a Saturday, covering information that all first-time homebuyers should know in order to make well-informed decisions and become an empowered and educated consumer. Courses are led by a certified NHSNYC Homeownership Counselor and include presentations by experts such as loan officers, real estate lawyers, home inspectors, real estate agents and home insurance agents. Key topics include: credit requirements, effective money management techniques and overviews of the mortgage application and home buying processes. Graduates from this course receive an NHSNYC Homeownership Education Certificate.

Bronx NHS

Virtual

Free

English

Monthly 1.5 hour courses.